Saving and managing money has been in people’s minds since the beginning of time. We have come a long way in the tools we use to look after this most essential part of our life. A good example is a compound interest calculator. Simple to use and does a marvellous job of helping you calculate how your savings are growing.

Do you know what is compound interest?

Compound interest is one of the keys to reaching financial success. By investing and saving money wisely, you can build wealth over time and reach your financial goals faster. Compound interest is a powerful tool that allows you to grow your money faster. It is the process of earning interest on the principal amount and then earning interest on the previously accumulated interest. In other words, the interest you earn on your investments and savings is added to the initial principal, and then the new total amount earns interest as well.

Compound interest is especially effective when used in long-term savings. Every extra dollar you save can earn more money over time, and that money can then be invested or saved again to earn even more money. The more you save and invest, the faster your money will grow.

One of the simplest and most effective ways to make use of compound interest is to start saving as early as possible. This allows your money to grow for longer periods of time and take advantage of compounding on a larger amount. You can also maximize your savings by making additional contributions when you can, such as from bonuses, raises, or other sources of income.

Apart from using compound interest, you can try these other money-saving challenges.

1. The 7-day challenge: This popular challenge requires that you save an increasing amount of money for each day of the week starting with 1 dollar on Monday and 7 on Sunday for the 52 weeks of the year. You can start this money-saving challenge anytime.

2. No-Spend Challenges: Earlier this year, a popular no-spend challenge faced the challenge of completely abstaining from spending money for a period of time. No-spend challenges are a great way to get an accurate look at where your money is going and to kick off better spending habits.

3. 30-Day Spending Detox: This challenge is similar to the no-spend challenge in its goal of taking a close look at where your money is going each month. Instead of abstinence from all spending, you’re encouraged to spend only when absolutely necessary, such as paying bills and filling up your car with gas.

4. The Latte Factor: This challenge is specifically geared towards eliminating discretionary spending from your budget. The name comes from the idea that if you give up just one latte a day, you can save over $1,000 a year.

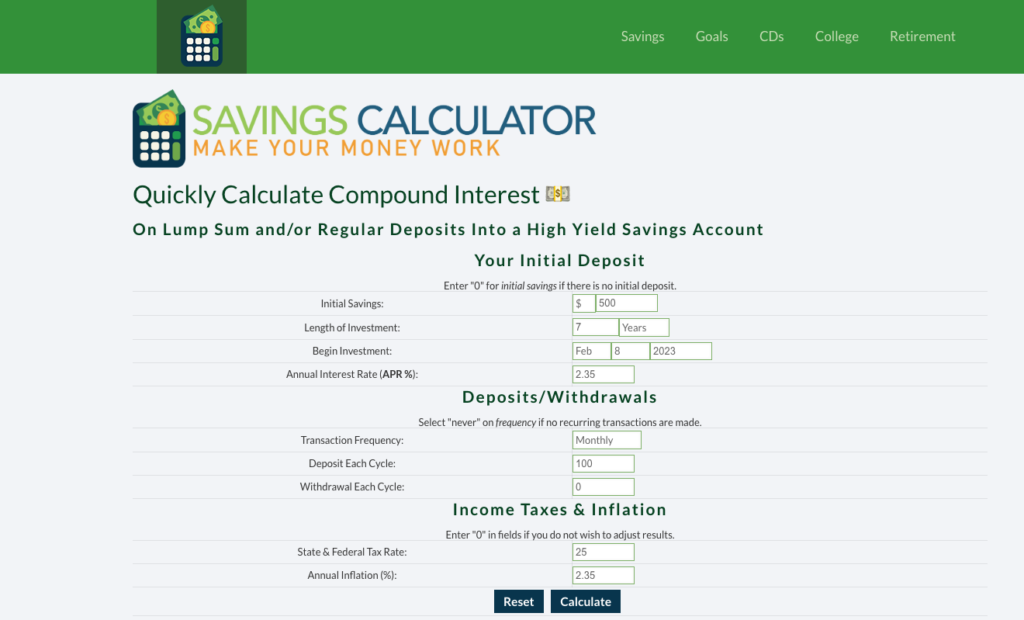

No matter which money-saving challenge you choose, you’ll be taking the first steps towards a better financial future. Take a look at the compound interest calculator.